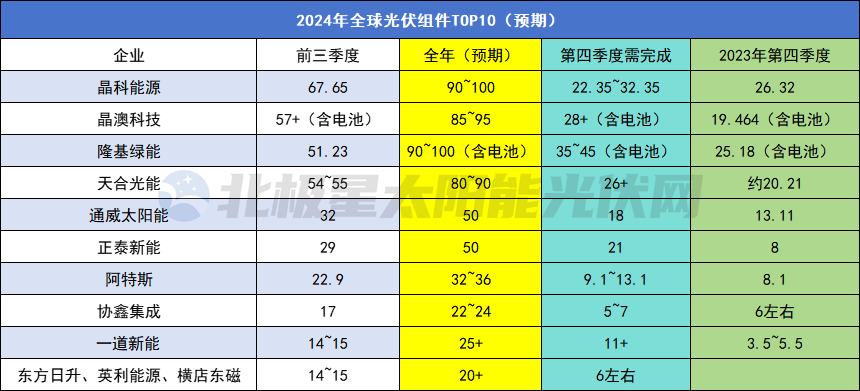

As the third quarter financial reports are released one after another, the solar panel shipment data of major module manufacturers in the first three quarters are released one after another. At the same time, the combination of the company's full-year module shipment expectations has also made the final PV module shipment dragon and tiger list in 2024 gradually emerge.

Before looking forward to the full-year data, you can first take a look at the shipment data for the first three quarters.

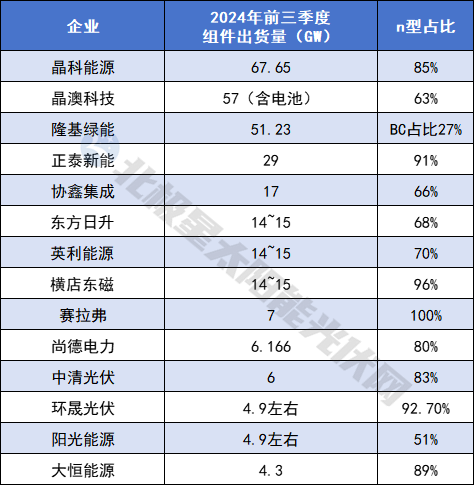

Polaris surveyed the data of nearly 20 module companies, combined with financial reports and survey data, and counted the TOP15 module shipments in the first three quarters. From the results, it is basically consistent with the ranking in the first half of the year, which also reflects the market law that the strong will always be strong.

Specifically, JinkoSolar firmly occupies the top position with nearly 68GW of module shipments, JA Solar has been firmly in second place since the first quarter of this year, by Trina Solar and Longi. These four giants also constitute the TOP4 of the photovoltaic module industry with absolute advantages, and the pattern has been stable for many years. As of the third quarter of this year, the total module shipments of the TOP4 reached 230GW+.

Next, the old giant Canadian Solar adheres to the principle of "profit first". After being surpassed by Tongwei at the end of last year, it was surpassed by Chint New Energy again this year. Also chasing closely is GCL Integration, which has been shortlisted for large central enterprise procurement orders this year, and its shipment performance is expected to hit a new high.

The most intense competition is still the "last train" of the TOP10. The data of the four companies, Risen Energy, Yida New Energy, Yingli Energy, and Hengdian Dongmei, are very close. The attractiveness of first-tier component brands can be seen, and the major companies that squeeze into the TOP10 can also be said to have done their best.

In addition to the TOP10, the rankings of TOP11~TOP15 companies are also relatively stable. Seraphim, Suntech Power, Zhongqing Solar, Huansheng Solar, Yangguang Energy, and Daheng Energy are leading the way, but it is obvious that the gap between their shipments and the TOP10 is still large.

At present, 2024 has entered the final battle. Between the choice of scale and profit, how will this year's rankings be presented?

Judging from the expected data of the company, JinkoSolar is likely to hold the ring and continue to maintain its top position in global photovoltaic module shipments. In the third quarter financial report, JinkoSolar pointed out that it will strive to achieve the annual shipment target of 90~100GW. Based on the data of the first three quarters, this also means that it needs to complete at least 22.35GW of module shipments in the fourth quarter, which is far lower than the data of the fourth quarter of last year. The bottom line is not difficult, and the goal is to rush to the highest line. At that time, it will also become the world's first company with annual module shipments reaching 100 gigawatts.

The data of JA Solar, Longi, and Trina are close. Among them, Longi expects battery and module shipments to be 90~100GW in 2024. In the first three quarters of this year, Longi's external sales of batteries were slightly lower than the same period last year. If the annual battery shipment data is the same as last year, it is estimated that Longi's module shipments this year will be 84~94GW, closely following JA Solar. However, to achieve the annual target, Longi's fourth-quarter shipment data needs to increase by more than 39% year-on-year, and JA Solar needs to increase by more than 44% year-on-year. Trina Solar can achieve its annual minimum target with a 29% year-on-year increase in module shipments in the fourth quarter, and it is unknown whether it can hit the top three.

Tongwei and Chint have similar module shipments in the first half of the year, and the gap is slightly widened in the third quarter. Both companies have anchored 50GW module shipments for the whole year. To achieve the goal, Tongwei's module shipments in the fourth quarter need to increase by 37% year-on-year, and Chint has a large gap, but it may be no surprise to rise to the top 6.

At the end of last year, Canadian Solar raised its forecast for module shipments in 2024 to 42~47GW, but under the principle of maintaining profits, the shipment target has been lowered to 32~36GW. Comparing the shipment data in the fourth quarter of last year and the estimated data in the fourth quarter of this year, it is not difficult for Canadian Solar to achieve its established annual target, and it remains stable. Although the shipment ranking has been declining year after year, Canadian Solar has maintained its profit rhythm from the first quarter to the third quarter of this year, especially in the first half of the year, the net profit attributable to the parent company increased by 321.75% year-on-year.

TOP8~TOP10, GCL-Polymer Integration's annual module shipment target for 2024 is 22~24GW, and it may rise from last year's TOP10 to TOP8 with a high probability. Yida Xinneng is far from its previous annual module shipment target of 25GW+, and may face the risk of catching up. Following it are Risen Energy, Yingli Energy, and Hengdian Dongmei, all of which are in the first-tier.

Of course, it is also worth paying attention to the company's n-type module shipments, which is also the key to leading the rankings at present. From the data, the proportion of n-type module shipments has increased rapidly.

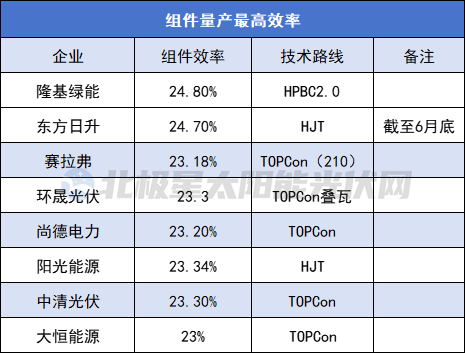

In addition, in terms of technical strength, from the company's public information, the highest mass production efficiency of the module is 24.8%. In early October, LONGi released the new Hi-MO X10 distributed photovoltaic product, announcing that the battery mass production efficiency exceeded 26.6% and the mass production module efficiency reached 24.8%. Following closely, Jinko launched the third-generation N-type TOPCon Tiger Neo 3.0 photovoltaic module, with a conversion efficiency of 24.8%. The hetero-junction production line of Risen Energy has a maximum efficiency of 24.7% for its hetero-junction modules. Previously, Huasheng New Energy officially announced that the conversion efficiency of its Himalaya series G12-132 heterojunction photovoltaic modules has reached 24.75%. (Source: Polaris Solar Photovoltaic Network Author: Shui Qimu)

online service

online service +86 (0592)5663849

+86 (0592)5663849 sales@uisolar.com

sales@uisolar.com solar-mount.au

solar-mount.au