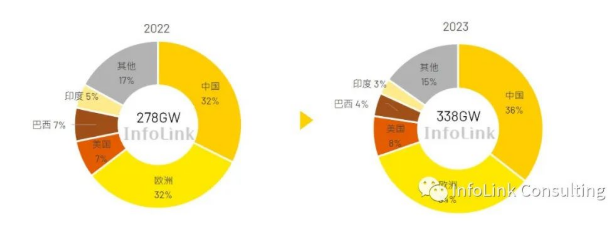

In 2022, after the high price of energy brought by the Russian-Uzbekistan war, the attention of countries to renewable energy has been greatly increased, and the photovoltaic market has therefore flourished. In 2022, the global module demand will reach as high as 280GW, with an amazing growth rate of 56.5% compared with 2021. In 2023, with the continuous promotion of energy transformation in various countries, InfoLink estimates that global demand will grow by 21.6% to 338GW.

The growth rate of the global market in 2023 will be lower than that of last year. In addition to the relatively high base period, the reason why the global photovoltaic market in 2022 can achieve more than expected growth is largely due to the impact of the Russian-Uzbekistan war and soaring energy prices, which have greatly stimulated the demand for renewable energy. If there is no similar sudden major impact this year, it may be difficult to achieve the same growth rate as last year; Looking closely at the markets of various countries, we can find that many countries with large market scale are facing policy difficulties this year, such as the United States' Xinjiang Act and India's BCD tariff, which lead to poor import conditions, and Brazil's start to impose grid usage fees on small distributed projects. The policy changes will make it difficult for the growth of the global photovoltaic market in 2023 to maintain the growth rate of last year. On the whole, even if the growth rate is lower than that of last year, it is still expected that the overall market demand will grow by about 60GW in 2023, and if countries can break through the policy restrictions, the demand will have the opportunity to grow further. Under optimistic conditions, it is expected that the global demand will have the opportunity to grow to 398GW.

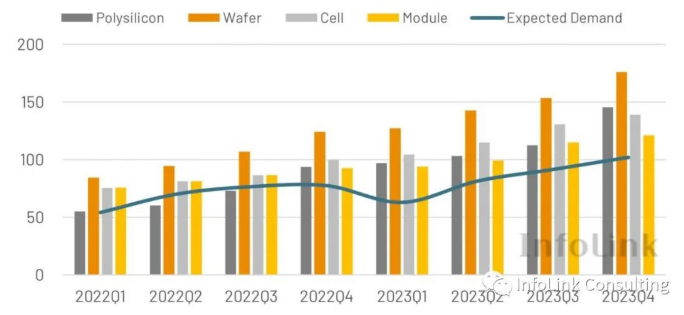

Compared with the growth of the demand side, the overall supply chain capacity expansion is relatively significant. In 2022, there was a serious shortage of silicon materials. At the beginning of the year, the total capacity was only 294GW. Compared with the demand of 280GW, there was a serious shortage of silicon materials. The shortage of silicon materials also made the overall supply chain price at a high level last year; However, by the fourth quarter of 2022, the large-scale production expansion plans of silicon material manufacturers have been implemented in succession, and the capacity will exceed 500GW by the end of 2022. The large volume of silicon material output has also made the overall supply chain price significantly loose at the end of last year. The price of silicon material and silicon wafer has dropped far more than expected, and the component price has also dropped from 0.265USD/W (2 RMB/W) at the beginning of November 2022 to 0.235USD/W (1.8 RMB/W) in the middle of January 2023.

According to the current production expansion plan, the overall supply chain will be in a situation of overcapacity in 2023, and the total capacity of each link will exceed 800GW by the end of 2023. The capacity of the first-tier manufacturers alone will be sufficient to meet the demand. The increase in concentration may lead to the difficulty of the second-tier and third-tier manufacturers in maintaining market share in the off-season, and the competition among manufacturers will become increasingly fierce, and the vertical integration layout of leading enterprises The overseas production expansion plan will also significantly affect the competition pattern. While the production of silicon material to components is expanded in a large amount, it should also be noted that the supply of auxiliary materials such as quartz crucibles used in the long crystal link and POE adhesive film for double-sided components may not be able to keep up with such a large-scale increase in production during the peak demand season, resulting in a temporary shortage.

Subdivide the changes in demand in each quarter. Europe and China in the first quarter are both traditional off-season, especially in the European market at the end of last year, due to the accumulation of inventory, the pulling power has been significantly weakened, and the impact may continue until the beginning of this year; India, which was affected by the local fiscal year in the past and would pull a large amount of goods at the beginning of the year, also suffered from the rapid shrinkage of the market due to the BCD tariff, which made the global market relatively cold in the first quarter; 2、 At the beginning of the third quarter, with the continuous decline of supply chain prices, it is expected that demand will gradually pick up. Until the end of the year, China will have another large-scale grid connection tide due to the decline of component prices, driving the demand in the fourth quarter to the peak of the whole year.

In terms of price changes, although manufacturers may cause short-term price fluctuations by adjusting the operating rate, the annual price trend still shows a significant decline due to the impact of oversupply. InfoLink estimates that the average component price in 2023 will be about 0.214 USD/W (1.673 RMB/W), a significant decline compared with the average of 0.266 USD/W (1.929 RMB/W) in 2022. Last year, many large projects were restrained by high prices, and manufacturers chose to postpone the installation schedule. The centralized installation in the United States decreased by about 37% compared with 2021, and the ground-based rush to install at the end of the year in China was not as obvious as before; In 2023, with the overall supply chain price falling, the delayed projects will start construction in succession this year, and stimulate the centralized market that performed relatively weak last year, further boosting the overall demand.

Compared with the oversupply in 2022, the photovoltaic industry will gradually turn into oversupply in 2023, which will drive the price down and facilitate the short-term expansion of demand. On the whole, we will remain optimistic about the market next year, but there are still many uncertain factors. In terms of policy, such as India and the United States, we must find solutions to the contradiction between protecting local capacity and developing the market; The European market may also face the impact of overall economic changes on demand next year, and the measures proposed for forced labor may also affect the development of PV in the future; The unsealing of China's epidemic situation and the change of the industrial competition pattern may cause short-term significant changes in supply. In the long run, the market size will continue to grow with the promotion of energy transformation by governments and the approaching of policy objectives.

online service

online service +86 (0592)5663849

+86 (0592)5663849 sales@uisolar.com

sales@uisolar.com solar-mount.au

solar-mount.au