1. Industrial Chain

(1) Upstream: polysilicon and silicon wafers

Polysilicon is the most upstream link in the photovoltaic industry chain and the basic raw material for manufacturing monocrystalline and multicrystalline silicon materials. In the silicon wafer sector, Jiangji Green Energy and Zhonghuan Semiconductor have successfully dominated the silicon wafer market supply structure by continuously increasing investment in technological innovation, continuously optimizing production processes, and actively promoting capacity expansion strategies. Their products are not only widely used in the domestic market, but also exported to many countries and regions overseas. In terms of silicon wafer technology, large-size and thin-wafer technology are the main development trends. Large-size 182mm and 210mm silicon wafers have become the mainstream market, with a market share exceeding 95%. At the same time, with the development of N-type cell technologies such as TOPCon and HIT, the demand for N-type silicon wafers is growing rapidly, and the market share of N-type silicon wafers is expected to exceed 50% in 2025.

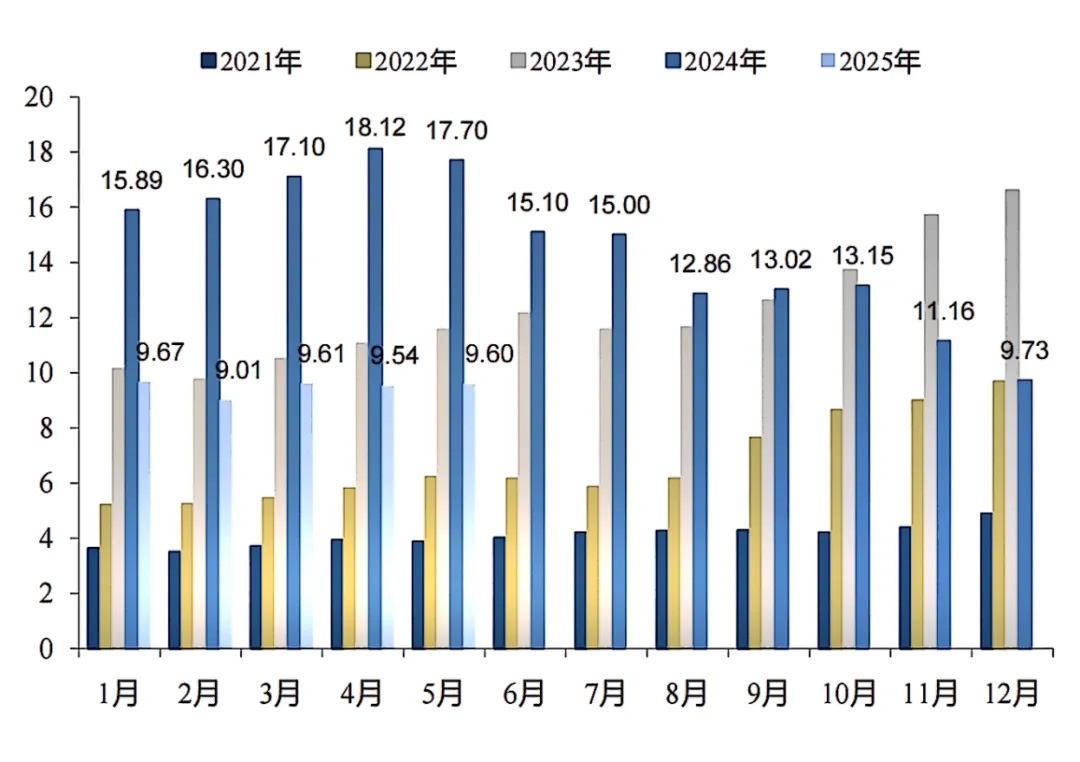

Figure: Domestic polysilicon monthly output (10,000 tons)

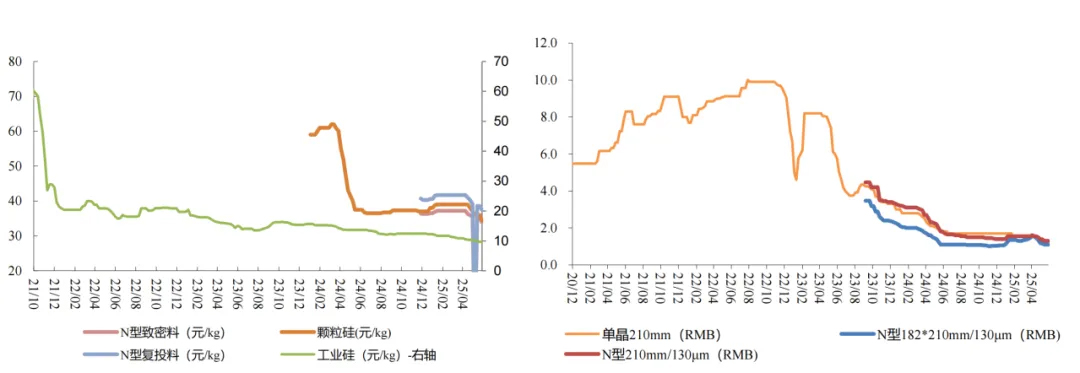

Chart: Silicon wafer price trend

(2) Midstream: Battery Cells and Components

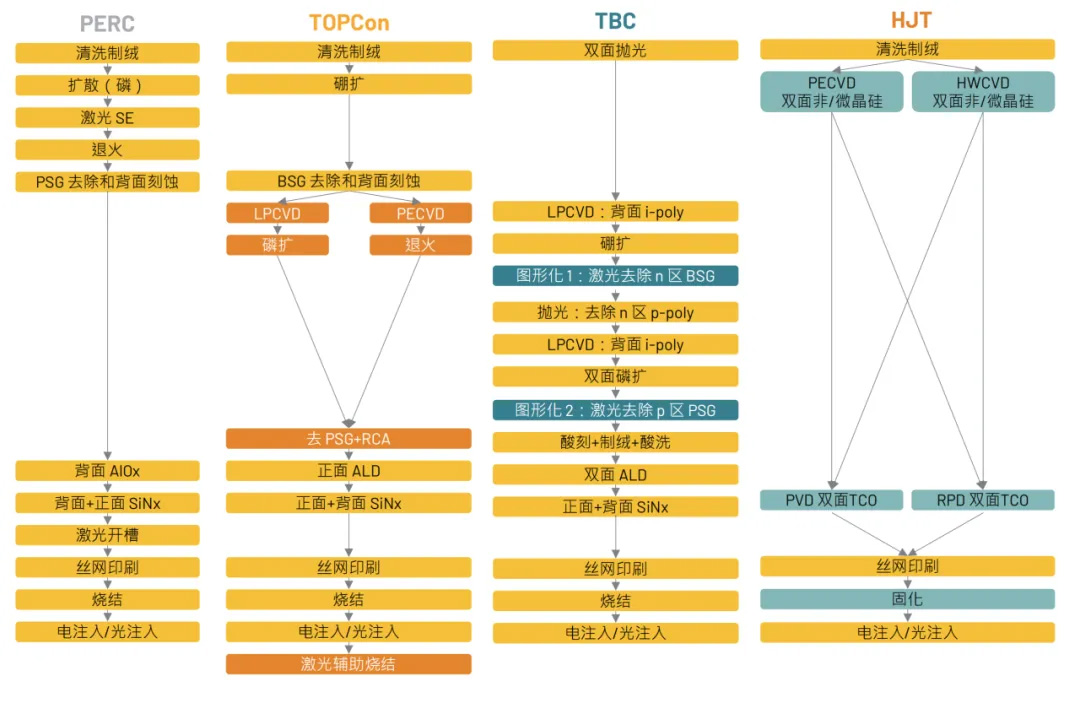

Solar cells are a core component of the photovoltaic industry chain, and their conversion efficiency directly impacts the power generation performance of photovoltaic systems. Currently, the main solar cell technologies on the market include PERC, TOPCon, HJT, and xBC. The theoretical upper limits of conversion efficiency vary among different technology paths: PERC is 24.5%, TOPCon is 28.7%, HJT is 28.5%, and xBC is 29.1%. In terms of mass production conversion efficiency, PERC is approximately 24%, TOPCon is approximately 26%, HJT is approximately 26%, and xBC is approximately 27%.

Figure: Comparison of cell processes

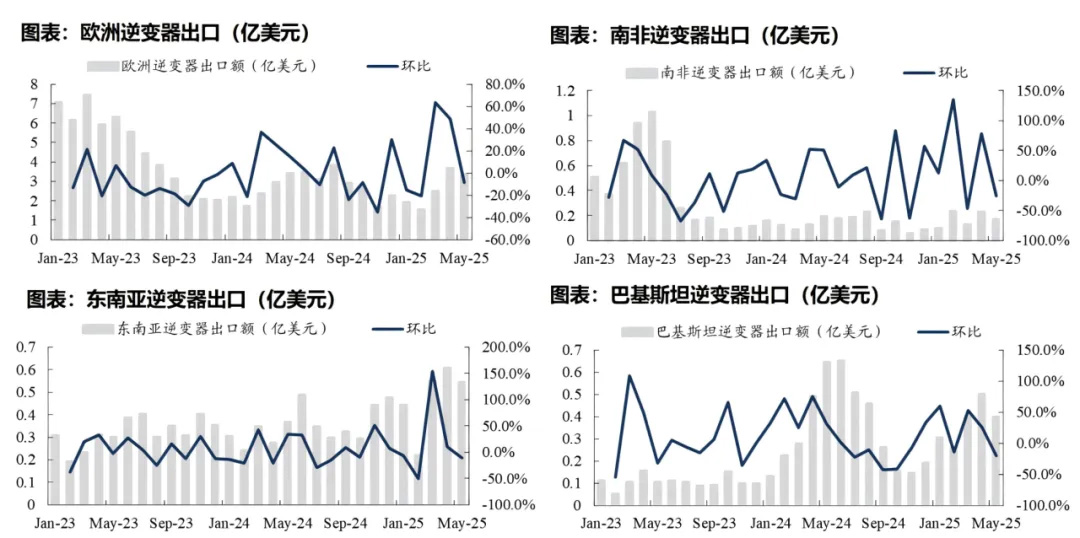

(3) Downstream: System Integration and Application

The downstream segment primarily includes photovoltaic system integration, installation, and operation and maintenance services. As the cost of photovoltaic systems continues to decline, application scenarios are expanding, from large-scale ground-based power stations to distributed photovoltaics, from building-integrated photovoltaics (BIPV) to water-based photovoltaics and transportation photovoltaics, forming a diversified application landscape.

By the end of March 2025, China's installed photovoltaic power generation capacity reached 945 million kilowatts, a year-on-year increase of 43.4%, including 534 million kilowatts of centralized photovoltaic power generation and 411 million kilowatts of distributed photovoltaic power generation. In the first quarter of 2025, China's newly connected photovoltaic power generation capacity reached 59.71 million kilowatts, including 23.41 million kilowatts of centralized photovoltaic power generation and 36.31 million kilowatts of distributed photovoltaic power generation.

In the distributed photovoltaic sector, both industrial and commercial distributed and household photovoltaics are experiencing rapid growth. In the first quarter of 2025, distributed photovoltaic capacity increased by 36.31 million kilowatts, accounting for 61% of the total new installed capacity, indicating that distributed photovoltaics has become the main driving force for market development. BIPV (building-integrated photovoltaics), as a key form of distributed photovoltaics, has enormous market potential. The BIPV market is expected to generate a total market value of over 86.6 billion yuan in 2025, with an overall penetration rate rapidly approaching 20%.

2. Domestic market size

China's photovoltaic market has maintained rapid growth in recent years. By the end of March 2025, China's installed photovoltaic power generation capacity reached 945 million kilowatts, a year-on-year increase of 43.4%. In the first quarter of 2025, 59.71 million kilowatts of new photovoltaic power generation capacity was connected to the grid nationwide, a year-on-year increase of 21%, accounting for approximately 90% of the newly installed capacity.

In terms of regional distribution, by the end of March 2025 , China's cumulative installed photovoltaic power generation capacity will include 534 million kilowatts of centralized photovoltaic power generation and 411 million kilowatts of distributed photovoltaic power generation. In terms of power generation, in the first quarter of 2025 , China's cumulative photovoltaic power generation reached 232.8 billion kilowatt-hours, a year-on-year increase of 43.9% , and the national photovoltaic power generation utilization rate reached 93.6% .

From the perspective of market growth drivers, first, policy support continues to increase, and governments at all levels continue to increase their support for the photovoltaic industry under the " dual carbon " goal; second, the cost of photovoltaic power generation continues to decline, grid parity has been achieved, and market competitiveness has been significantly improved; third, application scenarios continue to enrich, and new application scenarios such as distributed photovoltaics and BIPV are developing rapidly.

3. Application scenario analysis

(1) Centralized photovoltaic power station market

Centralized photovoltaic power stations are one of the primary forms of photovoltaic power generation in China. By the end of March 2025, the country's cumulative installed capacity of centralized photovoltaic power generation reached 534 million kilowatts, a year-on-year increase of 17.2%. In the first quarter of 2025, 23.41 million kilowatts of new centralized photovoltaic power generation was connected to the grid nationwide.

China is actively promoting the construction of large-scale wind and photovoltaic power plants, primarily in deserts, Gobi deserts, and wastelands. Plans are underway to build 450 million kilowatts of large-scale wind and photovoltaic power plants in the Kubuqi, Ulan Buh, Tengger, and Badain Jaran deserts. These projects will effectively promote the large-scale development of the photovoltaic industry and increase the proportion of photovoltaic power generation in the energy mix.

Centralized photovoltaic power plants are characterized by large scale, high power generation efficiency, and low costs. However, they also face challenges such as land resource constraints and limited grid absorption capacity. Especially in the context of declining subsidies, the economic viability of centralized photovoltaic power plants has become a key factor in project development, which has also driven the arrival of the era of grid parity.

(2) Distributed photovoltaic market

Distributed photovoltaics (PV) is a key form of photovoltaic application. The distributed PV market is experiencing rapid growth, particularly with declining PV costs and a growing number of application scenarios. By the end of March 2025, the cumulative installed capacity of distributed PV in China will reach 411 million kilowatts, a year-on-year increase of 43.9%. In the first quarter of 2025, 36.31 million kilowatts of new distributed PV capacity was connected to the grid nationwide, accounting for 61% of the total newly installed capacity, demonstrating that distributed PV has become a major driver of market development.

With the deepening of market-oriented reforms to industrial and commercial electricity prices and the reduction of photovoltaic power generation costs, the economic viability of industrial and commercial rooftop photovoltaic projects has significantly improved, and the market potential is enormous. This is particularly true in the eastern coastal areas, where industry and commerce are developed and electricity consumption is high. Distributed photovoltaics can effectively reduce corporate electricity costs and improve energy efficiency.

In the residential photovoltaic sector, the market in rural areas is rapidly developing with declining system costs and supportive subsidy policies. In the first quarter of 2023, 33.66 GW of new photovoltaic capacity was installed, a year-on-year increase of 34.9%. Household photovoltaics not only provide farmers with clean electricity but also increase their income by connecting surplus power to the grid, offering significant economic and social benefits.

(3) Innovative application scenarios

With the advancement of photovoltaic technology and the reduction of costs, the application of photovoltaics continues to expand, and innovative application scenarios continue to emerge. Among them, BIPV (building-integrated photovoltaics) is one of the most rapidly developing innovative applications in recent years.

BIPV is a technology that integrates solar power generation (photovoltaic) products into buildings, which is different from the form of photovoltaic systems attached to buildings. It is estimated that the BIPV market will generate a total market space of more than 86.6 billion yuan in 2025, and the overall penetration rate will quickly approach 20%. The development of the BIPV market has benefited from the joint promotion of policy support, technological advancement and market demand. Policy support: The national "dual carbon" strategy has promoted the development of the BIPV industry, and many regions have introduced policies to encourage the promotion of distributed photovoltaic and BIPV projects. Strong market demand: With the popularization of green building concepts, the application of BIPV in residential, industrial buildings and public facilities has gradually expanded, especially in the field of rooftop distributed photovoltaics.

In addition to BIPV, new applications such as waterborne photovoltaics and transportation photovoltaics are also rapidly developing. Waterborne photovoltaics, such as fishery-solar hybrid projects, not only improve land use efficiency but also generate additional revenue, with average annual returns per mu reaching 20,000 yuan (compared to approximately 5,000 yuan per mu for traditional fisheries). Transportation photovoltaics, such as those on highway noise walls and in service area carports, can generate up to 1MW of capacity per kilometer, providing new energy solutions for transportation infrastructure.

(4) Integration and converged development of photovoltaic and storage

With the continuous expansion of photovoltaic installed capacity and a high proportion of photovoltaic power connected to the grid, the intermittent and volatile nature of photovoltaic power has brought challenges to the safe and stable operation of the grid. To address this problem, integrated photovoltaic and storage has become a new trend in the development of the photovoltaic industry.

Integrated photovoltaic (PV) and energy storage combines photovoltaic (PV) power generation with energy storage systems. This system uses the energy storage system to smooth out fluctuations in PV output and enhance the grid's ability to absorb renewable energy. Driven by policy support and technological advancements, integrated PV and energy storage projects are rapidly developing. As a key player in the new energy sector, China's PV and energy storage industry is experiencing a critical period of rapid development. From 2025 to 2030, this industry faces numerous opportunities and challenges. Its development trajectory not only impacts the optimization of China's energy structure and the achievement of its sustainable development goals, but also has profound implications for the global clean energy transition.

4. Photovoltaic product solutions

The photovoltaic industry, an emerging green energy sector that directly generates electricity from solar energy, is experiencing rapid global growth. Huaxia Blue is leveraging innovative technologies to support the green energy transition and has launched a series of photovoltaic product solutions to help accelerate energy restructuring and advance the "dual carbon" goals

online service

online service +86 (0592)5663849

+86 (0592)5663849 sales@uisolar.com

sales@uisolar.com solar-mount.au

solar-mount.au